Perfect Step To Start

Understand how to improve your credit Report & Score from the comfort of your own home

This guide will break down each step of the process. This is something you can reuse in the future or to help others in your family rebuild their credit. This guide allows you to do things at your own pace from the comfort of your own home, even the postage.

Is This You?

- Are you struggling to get approved for credit cards and/or car loans?

- Never had any credit cards or loans and want to learn how to Increase your score?

- Don’t understand why you’re not getting a loan approval?

- Collections, Charge Offs, and other negative items keeping your score down?

- Want a higher credit score but don't know how to get there

- Interested in business credit?

If you answered “Yes” to any of these questions, Then This Guide Is For You!

70% of credit reports have some type of errors/outdated information on them SO YOU ARE NOT ALONE!!

This guide will teach you what you need to know regardless of your current credit score/report looks.

This guide is what you need to take your financial situation to the next level. Proven Strategies that have be used by me personally and by my clients.

LET’S put an end to

- Loan Refusals

- Low Credit Scores

- Credit reports with outdated information

- Unprepared For Handling Inquiries

and YES to....

- Loan Approvals

- Higher Credit sores

- Credit Reports that meet lending Criteria

- Understanding of Credit reporting and your rights as a consumer

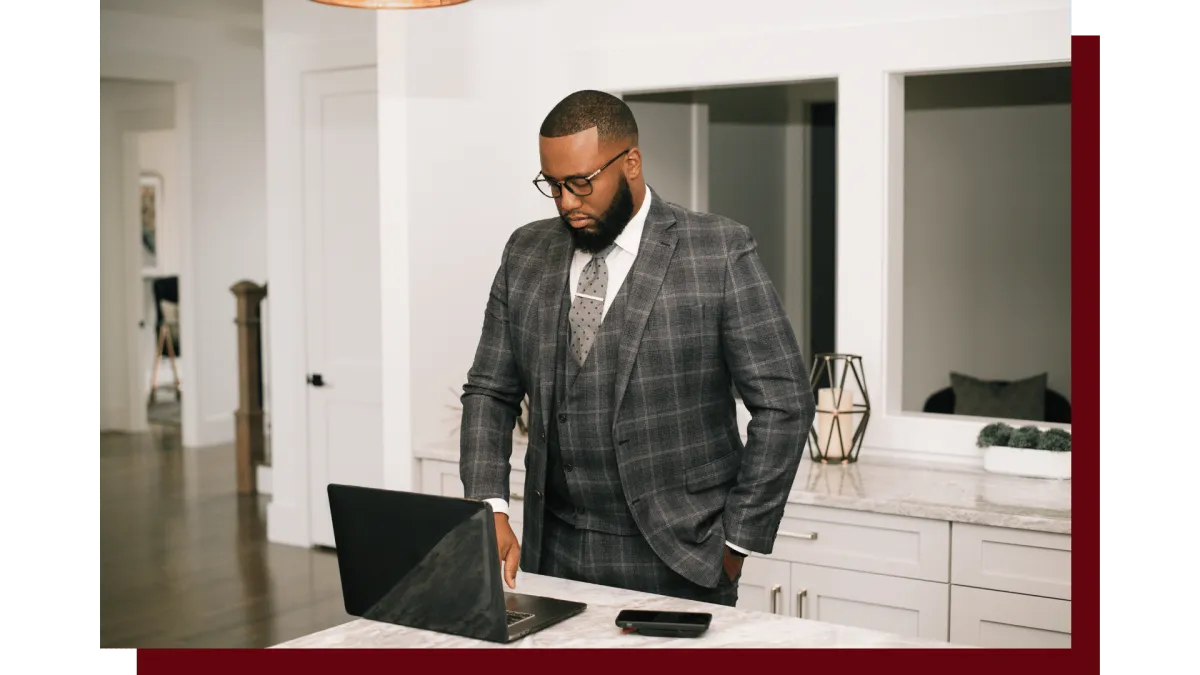

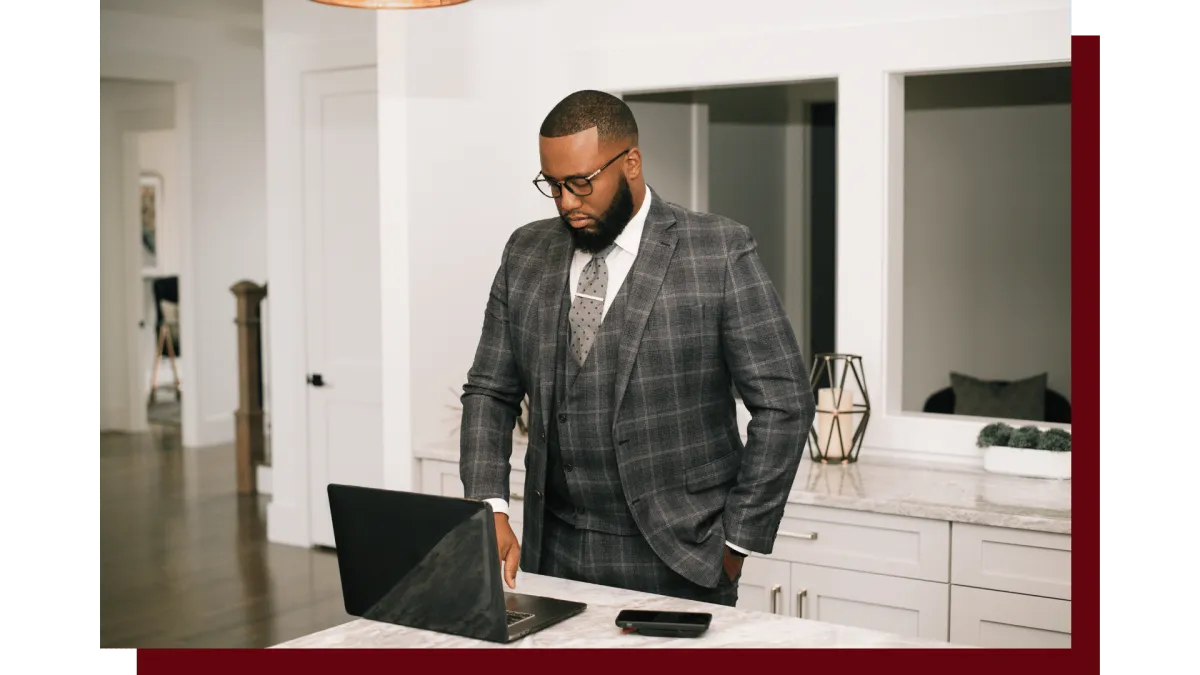

Meet Kendall Toney

Hi!

I am Kendall Toney, your trusted advisor and Certified Credit Consultant. As a real estate professional, I have daily conversations with people about their credit scores, how to improve them, and what specific changes need to be made in order to get a Loan Approval.

Meet Kendall Toney

Hi!

I am Kendall Toney, your trusted advisor and Certified Credit Consultant. As a a real estate professional I have daily conversations with people about their credit scores, how to improve them and what specific changes need to be made in order to get a Loan Approval.

Contents of the DIY Credit Guide. VIDEOS detailing each step included.

Intro To Credit Restoration

- Video Introduction

- Intro to credit

- DIY Guideline

- Understanding the steps

Out of Secondaries & Big 3

- Video Introduction

- Opt Out of of secondaries & Big 3

- Dispute Breakdown

- Letterstream

Sending Letters

- Sending Dispute Letters from home

- Verification Strategies

- Communicating with the Bureaus

- FCRA communication & Rights

Collections

- Ceasing Phone Calls

- Stop Collection Procedures

- Dealing with collection agency

- Negotiating

- Chex System

- Medical Collections & Hippa Violations

Liens, bankruptcy, Repossession

- Inconsistencies with how repossessions and how to challenge them

- Understanding BANKRUPTCY dispute process

Identity theft

- Who is the FTC and its importance

- Dispute Strategies

- Identity theft

Late Payments

- Late Account Dispute Strategies

Rebuilding your Credit

- Restoration basics

- Rebuilding your credit guideline

Restoration Guide Includes

Credit

History

FICO Score Essentials

Credit Repair Strategies

Good Credit Report

Late Payment Removals

Undiscovered

Problems

In Credit Finances

Business

Credit

This Is A Limited-Time Offer. Make Sure To Enroll Now Before It Is Gone!

Thanks for taking the time to read about my DIY Credit Restoration Guide! My biggest intention is to help as many families as possible to be financially free in the near future. I know the impact we can make.

If you’re curious about learning why 95% of individuals like yourself fail to acquire their new

home, a dream beach house, or a new motorbike, and if you don't want to be among one of

Then, I encourage you to read on just to see what it’s about,

Thank you for being here,

Kendall Toney

Success Stories

Rather have someone help you with Credit Restoration??

- Overview of your credit report

- Overview of credit and Fair credit reporting act

- What's hurting your credit score/report

- Things that will increase your score quickly

- Strategies of challenging the any adverse items on the report

- How to get the perfect credit mix

- What's needed to get approved for a loan

The very first thing discussed during the consultation is the borrowers credit score…. Nothing can move forward without meeting the mortgage score criteria for lending. Furthermore, this conversation is very important because a low credit score and adverse report will prevent a borrower from getting an approval for many things such as a credit card, car loan, insurance, and even a Job. So I’d like to share the ebook along with the DIY Credit guide together in a special offer. Both Guides will give insight and information you need to ensure your moving in the right direction.

Copyright 2022 | Toney Realty Group | All Rights Reserved